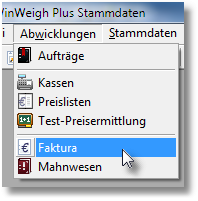

WinWeigh Plus Module

Invoicing

Invoicing is a process in accounting in which an invoice is issued to a customer or supplier for deliveries and/or services that have been made (or, in rare cases, foreseen). During invoicing, the business case is also posted to assigned accounts (sales revenue, receivables or cash, possibly sales tax). Both the invoicing process and the invoice itself are subject to various minimum requirements (especially under commercial law and tax law): For example, the invoice must contain the name and address of both the invoicing party and the recipient of the invoice, a list of all goods supplied and services rendered together with their price, VAT amounts if applicable, payment terms, the date of issue, a unique invoice number and the company’s tax number.

By invoicing with WinWeigh Plus you are able to lead the recorded deliveries to customer-related collective invoices. Even construction site-oriented accounting is taken into account. A number of other filters and settings allow you to influence the scope or method of invoice generation. In addition to creating document-oriented collective invoices, you can also use the Invoice module to create your own invoices, which do not refer to pre-entered deliveries.

The organization and maintenance of master data is of particular importance for effective use of the billing system.

Of course, special attention is paid here to the customer master, because here the invoice recipients can be parameterized for invoicing (invoicing method / price list / payment terms / calculate tax / …).